Certifying Acceptance Agent services

Kent Notary Public is authorised by the Internal Revenue Service (IRS) to help non-US citizens get an Individual Taxpayer Identification Number (ITIN) so that they can pay tax in the US.

Kent Notary Public is authorised by the Internal Revenue Service (IRS) to help non-US citizens get an Individual Taxpayer Identification Number (ITIN) so that they can pay tax in the US.

Why use a Certifying Acceptance Agent?

As an established and trusted provider of Certifying Acceptance Agent services, we offer services that few others in the UK can carry out for you. If you own a business or property in the US that you need to pay tax on, then you will need our assistance to guide you through the process of getting an ITIN. Without the help of an agent such as ourselves, the process of getting an ITIN will be much more stressful, complex and time-consuming.

We can do the following for you:

- Certify your identification documents so that you do not have to risk sending your original important documents all the way to the US, and avoid the stress that would come with doing that

- Review your documents

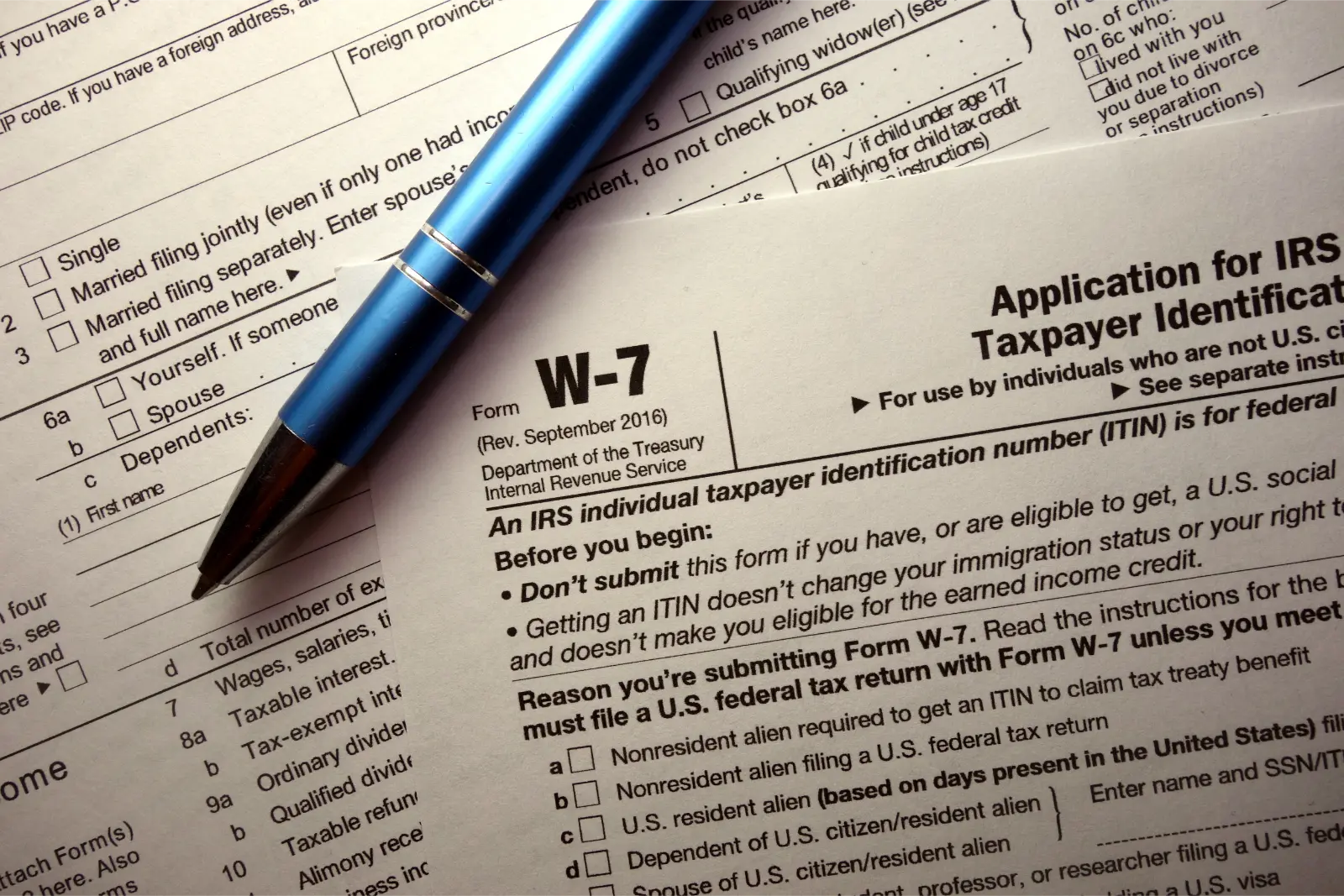

- Help you prepare and submit the W-7 Certificate of Accuracy form that is needed for an ITIN application

- Receive your ITIN number on your behalf and provide you with a copy.

By using our services, you will avoid having to be without your original identity documents (e.g. passport). If you apply for an ITIN by yourself, your original documents could take up to eight weeks to be returned to you. With your documents being away for so long and going through different postal systems, there is always a risk that they could go missing. With us, you will avoid this problem.

Who can use our services?

We assist a range of clients, and tailor our services to each one:

- Individuals

- UK corporates and businesses

- International corporate organisations

- Certified public accountants

- Enrolled agents

What is an ITIN used for?

An ITIN is solely used for tax purposes, and it can be used for the following:

- Filing a US tax return

- Receiving a US-sourced income

- Pay tax if you are a non-resident spouse/ dependent of a US citizen/ resident

- Claiming a US tax refund

- Having an investment account in a US bank

- Selling US real estate

What can an ITIN not be used for?

There are a few things that an ITIN does not allow you to get; these include:

- Entitle you to social security benefits and does not change your immigration status or your right to work in the United States

- Qualify a dependent for Earned Income Tax Credit purposes

- Claim the earned income credit using an ITIN.

Contact us for our expert advice

Kent Notary Public provides convenient solutions for all your notarial needs. Also, we offer additional services such as apostille, legalisation, translation and document drafting if required.

Finally, we offer mobile notarial services at a location of your choice throughout Kent and the surrounding areas.

Get in touch today to see what we can do for you.