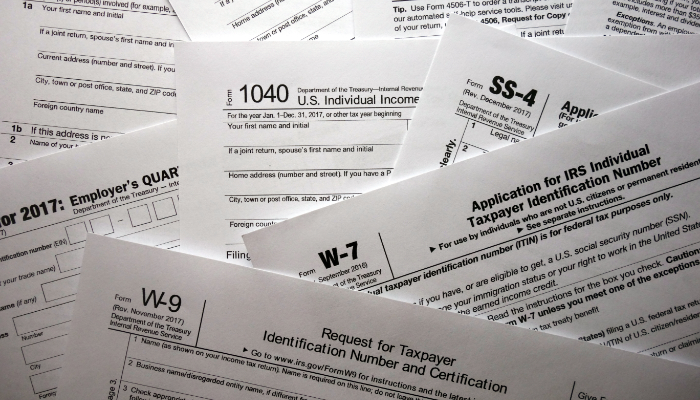

As a Certifying Acceptance Agent (CAA), Kent Notaries is authorised by the Internal Revenue Service (IRS) to assist alien individuals and other foreign taxpayers who are not eligible to obtain a Social Security Number (SSN) with applying for an Individual Taxpayer Identification Number (ITIN).

WE ARE YOUR ONE STOP SOLUTION FOR ALL YOUR NOTARIAL NEEDS

Individual Taxpayer

Identification Number (ITIN)

As ITIN specialists, we take the time to fully understand your situation so that we submit your Form W-7 application in accordance with the set rules and procedures, significantly helping to reduce any likelihood of your ITIN application being delayed or rejected by the Internal Revenue Service (IRS).

Kent Notaries offers the following services:

Why use a Certifying Acceptance Agent?

As an established and trusted Certifying Acceptance Agent, Kent Notaries offers a convenient and hassle free way to apply an IRS ITIN number. We can:

You will avoid having to be without your original identity documents (e.g. passport) for up to 8 weeks by using Tax Preparation Services. Additionally, you will be taking zero risk of losing your original documents or having to worry about mailing them overseas to the IRS.

Who can use our services?

We can assist many clients including:

What is an ITIN used for?

An ITIN is solely used for tax purposes. An ITIN can be used for the following:

What can an ITIN not be used for?

An ITIN does not:

info@kentnotaries.co.uk

01622962466

Monday to Friday 9 am – 5 pm

Mr Nathan Woodcock is regulated through the Faculty Office of the Archbishop of Canterbury for work undertaken by him as a Notary Public (Admitted Notary Number: 620365). Mr Nathan Woodcock operates his practice through Woodcock Notary Public Limited (Co. No: 12085976). Mr Nathan Woodcock is a member of the Notaries Society and the Common Law Association of Notaries.

Terms of Use | Privacy Statement | Cookie Policy | Disclaimer

Designed by Woodcock Marketing | Copyright 2024 | Woodcock Law & Notary Public | All Rights Reserved.